| High | Low | High | Low | |||

| EUR/USD | 1.1431 | 1.1340 | USD/ZAR | 11.9054 | 11.8447 | |

| GBP/USD | 1.5790 | 1.5728 | GBP/ZAR | 18.76 | 18.67 | |

| EUR/GBP | 0.7245 | 0.7208 | USD/RUB | 51.44 | 47.77 | |

| USD/JPY | 119.35 | 118.88 | USD/NGN | 199.3 | 199.0 | |

| GBP/CHF | 1.4445 | 1.4381 | S&P 500 | 2,109 | 2,096 | |

| USD/ILS | 3.8459 | 3.8197 | Oil (Brent) | 67.31 | 66.84 | |

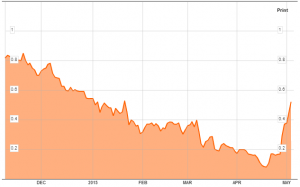

How often have we had strong economic data published in the United States or United Kingdom, but lagging data from the Eurozone. It has been the norm over the last few years, but a funny thing is happening, this week we’ve seen disappointment from one of the former stalwarts and positive surprises from the laggard. A few data points don’t make a proper population, and certainly the disappointing data from the United States is within a context of still fairly solid albeit unspectacular growth. This seems to be more about Eurozone catching up than the already recovering western economies really slipping back. Nevertheless the less the financial markets have taken note, and the dollar has softened in recent sessions. What had recently looked liked the end of a 2 month correction in the greenback from the highs of mid-March is morphing into a potentially deeper correction. My original assumption of a possible retracement up to the 1.18 – 1.20 zone in EUR/USD looks more and more realistic. One things is for certain, the 1.1392 high has now been violated, so I can tell you officially that the US dollar bull trend has not re-started.

The poor data in question in the United States was flat retail sales growth for April, which following on from the weak Q1 GDP numbers of +0.2% (vs 1% forecast) recently published, paints a less cheerful picture of the U.S economy than what we’ve become accustomed to. Not surprisingly speculation is rising that these lacklustre numbers are likely to push back the first interest rate rise. One of the pillars supporting the strength of the greenback has always been the expectation of earlier rate rises across the Atlantic. If that is no longer the case, it’s no surprise that some of the gloss will come off the US dollar. In a recent speech, Federal Reserve Bank of San Francisco President John Williams described himself as being in ‘wait and see mode’. This is fair enough, and he pointed out that with the next meeting in June, there will be a lot of data that can be studied between meetings to facilitate the interest rate decision. It’s worth noting that there are increasing questions about the efficacy of seasonality adjustments used in US GDP calculations. I have some sympathy with this, given the dramatic jump in growth data in Q2 and Q3 last year, in comparison to Q1. Perhaps the same is in store for us again?

On the other side of the Atlantic, the news from the Eurozone has been surprisingly good, and it’s the laggard nations of France and Italy in particularly that positive surprises have come. Germany has, if anything, been disappointing. If the trend continues, this is fantastic news for the Eurozone, but I think we need to be cautious about the meaning of this, and its sustainability.

Governor Carney in the UK, despite solid growth, has not contradicted market expectations that the earliest time to expect rate rises is next year. GDP growth forecasts for this year were trimmed to reinforce the point. This didn’t do much harm to the pound sterling though, which just illustrates the dollar’s weakness over the last few sessions.

The greenback is most certainly not the weakest currency of the moment, that title goes the Ghanaian cedi which has made new record lows. Coupled with the stresses the naira is experiencing in post-election Nigerian, it is clear that the impact of last year’s commodity meltdown are still rippling outwards.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc