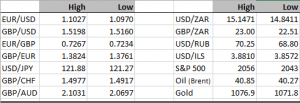

Currency markets have had an interesting few days. In a larger sense the dollar retreating again is the biggest news and we’ll come to that shortly. But first it’s hard not to notice the tough trading conditions for emerging market currencies. Despite the stories being seemingly country specific – like the South African rand blowing up after President Zuma’s sacking of the Finance Minister; or the technical weakness being inflicted on the naira because the central bank of Nigeria (CBN) is tightening the AML compliance of local bureau de changes; or the impeachment circus in Brazil – the fact that so many currencies are under pressure against the dollar is painting a picture. The narrative is that the dollar is strengthening, and a sell off against its g10 peers is not enough to hide that fact.

In speaking with a trader whose skills and success in the currency markets merit the highest respect, I have begun to dampen my enthusiasm for the bullish dollar case. There is clearly still a fear amongst currency traders that the capitulation out of dollar longs, precipitated last week by Mario Draghi’s disappointing revelations about what the ECB plans to do to about the quantitative easing programme, is not over yet. My trader friend believes that the market is still long dollars versus g10 peers and these bouts of dollar selling might persist for some time. That may well be the case, but from a technical perspective I would still contend that dollar selloffs are counter-trend moves and only a rally above 1.5340 in GBP/USD or perhaps 1.1090 in EUR/USD will dissuade me of that. We will know either way next Wednesday evening when the FOMC announces its decision, and we can observe the price action that ensues.

Markets are limping their way to the end of 2015. The S&P 500 is now flat, perhaps even a few points down for the year. Obviously the FOMC decision represents a significant twist in the tail for the story of 2015. It would be unwise not to expect large moves either way, based on the interest rate decision to come. The same will apply for currency markets as well, but the travails in emerging market currencies reminds us that there are other important stories out there that will have a role to play.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc