Lift off! At last for the first time in almost a decade interest rates in the United States are rising. I read somewhere that the last time rates were hiked iPhones didn’t exist, crazy right!? Last night the FOMC raised interest rates from 0% to 0.25% in the United States. But as we have stated repeatedly this week in the lead up to this momentous event, it was never about the hike itself. This has been so well flagged, no doubt even sheepherders in the North Korean countryside have been anticipating this! No this was about the wording, the thought process behind what comes next. If there is such a thing as a dovish hike, this was it. The dollar sold off briefly in the aftermath, and equities rallied, then as Chairwoman Yellen began to answer questions the dollar began to recover even as equities continued higher. It’s like the risk markets have been holding their breath and they could suddenly collectively exhale. The interest rate outlook the FOMC posits is a good deal more hawkish than the market’s current thinking and indeed where the relevant assets like Eurodollar futures and the 2 year treasury yield are priced. There’s reason to believe that it’s a red herring though, given the emphasis Yellen put on monitoring actual data before proceeding with further tightening.

Watching the Chairwoman, I got the sense that this was a decision, she was personally keen to push through, and she did it for many of the reasons I have talked about over recent months. A central bank needs room to manoeuvre if things take a turn for the worse, and a starting point of 0% is no place to start! Furthermore, as Yellen kept saying, let’s not make too big a deal about this, it’s only 25bps after all. Going forward the Federal Reserve will pay especial attention to the labour market and perhaps even more focus on core inflation trends. She was quick to point out that if inflation trends, as represented by the core PCE number does not in fact start to move back towards the 2% target zone (the last print was 1.26% I believe), then they would have to re-assess their outlook. It is clear that they will be focussing on testing their outlook rigorously against the real data that is presented to them over the coming months. Other items that will factor in future FOMC debates include external demand conditions and the strength of the dollar, but to a much lesser extent clearly.

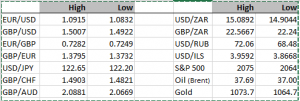

Talking about the dollar, as the post-meeting Q&A continued the initial sell off of the dollar slowed and by late evening the dollar was rallying strongly again. I reiterate our view that we are likely to see a re-test, and breach of the lows in EUR/USD and GBP/USD from earlier on in the year. We will see new dollar highs versus these currencies soon. That alone will slow the pace of future hikes but it is likely that we will see some hikes in 2016, assuming current growth trends persist. This has been a well flagged operation so it’s no surprise that emerging currencies, while weaker, are not in crisis mode this morning. Everyone expected this.

Looking at GBP/USD the recent 1.4894 low is the first test, once that goes the pre-election lows of April around the 1.46 level will be the next target. I don’t think we’ll get there this year, but I wouldn’t be shocked if it happened, because from a technical perspective an impulsive move for GBP/USD is in order. I will speculate that the Bank of England is keen to see sterling weakness for both competitive and inflationary reasons, but if it starts to feel like it’s getting away from them then they’ll make it known that interest rate hikes are coming. What I don’t know is what the trigger level is.

For now, we continue to expect steady dollar strength across the board. Keep an eye out for USD/NGN, that’s not dollar strength being reflected, that’s extreme naira weakness!

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc