It’s easy to forget that after the United States, China and the Eurozone, Japan still represents the next most important major economy. The news has been pretty good recently, stunning upwardly revised GDP data, and then yesterday a stronger than expected Tankan report, it looks like the Bank of Japan (BoJ) won’t be pressured into easing monetary policy further for now. The Tankan report is especially cheering with large manufacturers showing positive sentiment versus the expected decline. This implies that Japanese corporates are shrugging off the weakness in China and sluggish demand at home. Whether the better than expected sentiment turns into positive activity down the line is still open to question, but we note this more for the implications to near term BoJ monetary policy.

Yesterday we got some solid industrial production data from the Eurozone, with a much better than forecast +1.9% year on year industrial production number to October. I’m not going to get too excited and start calling these 2 bits of solid data as a major turnaround, but it’s encouraging stuff nonetheless. Couple that with marginally stronger than expected inflation in the UK, it’s and it looks like a veritable smorgasbord of good pre-Christmas macro data that we can feast on. Anything that isn’t harmful to the global outlook is merely going to reinforce the resolve the Federal Reserve appear to be showing. Please bear in mind that the FOMC has in fact already begun. It’s always a 2 day event. No doubt a more positive ZEW report in Germany later on this morning will only enhance the likelihood of an interest rate in the US, although I don’t want to over-estimate how significant these foreign data points will be to the US policymakers.

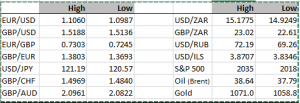

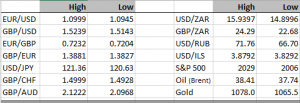

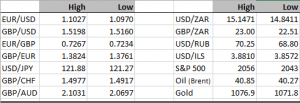

Later on today we get inflation data in the US, that will be more impactful for any rate decisions, but I daresay the FOMC board are already aware of the data before it becomes more publicly disseminated. For now G10 currency markets are trading in fairly tight ranges, and there is less pressure on emerging market currencies as the market seems to be holding its collective breath.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc