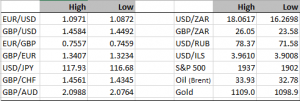

On the face of it, the non-farm payrolls number published on Friday was stunning. Economists had been expecting 200,000 new jobs created a drop from the number in November, but the reality was hugely more positive than that. 290,000 new jobs were added to the labour market which was an improvement on November’s 252,000, and a very solid end to the year (indeed the 3 month average indicates the fastest pace of jobs growth for the year). But as I said earlier… “on the face of it”.. because average hourly earnings were flat. The United States economy remains in a paradigm where unemployment is falling at a robust clip but workers still seem unable to negotiate better compensation despite tighter labour market conditions. One might argue that the narrow definition of the unemployed used is the problem, because when you add individuals who are capable of work but have given up searching – the U6 measure – then the unemployment rate jumps from 5% to about 10%, and perhaps it really is as simple as that. But is it? We are seeing exactly the same phenomenon in the United Kingdom, a seemingly tighter labour market but lacklustre wage growth. No doubt some labour market economist will come up with a treatise which explains the reason for this, but for now everyone is scratching their heads. Despite the dramatic strengthening of the dollar in the wake of the data, it is not clear that this will be considered sufficient by the Federal Reserve to start putting us on notice for a further rate rise. As I have mentioned in recent blogs, the FOMC will be keeping a careful eye on inflation risks, and at the moment I would guess the scales are tipping in the other direction – we see falling energy prices and stagnant wage growth, which looks more disinflationary than representing a threat of future runaway inflation. Perhaps that’s just me!

Elsewhere it looks like the pound sterling is taking a bit of a breather from its recent freefall. We continue to believe that sub 1.40 (versus the dollar) is possible before all is said and done, but as always with trends there will be pullbacks, and I believe that is what we are seeing today.

As I’ve mentioned before 2016 could continue the tough trading conditions for emerging market currencies. The South African rand has been the victim this morning falling to record lows, at one point USD/ZAR went as low as 18.06, if you recall just a decade ago USD/ZAR was trading at around 5! The word is that Japanese carry traders have finally decided to bail out of this currency and who can blame them, they buy currencies like the rand to earn superior levels of interest (why wouldn’t you if your home savings rate is 0% and you can earn 10% elsewhere?), but when the currency you invest in is making capital losses in excess of the interest you earn the exercise is pointless.

Elsewhere in the developing currency space, the naira continues to suffer, although as I’ve said before the naira’s losses are about par for the course when you look at other commodity dependent currencies. The central banks restrictions are biting and dollar supply in Nigeria is as thin as it’s ever been. I continue to believe that the only way things turn around for the naira is for alternative sources of foreign income are developed, and you don’t get that by maintaining an artificially expensive FX rate. The CBN continues to stick to a policy that was discredited in the 70s and 80s, sadly I don’t think much is going to change until economic realities are accepted.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc