The big story this week remains the unfolding drama of the British EU referendum and there’s not much that’s likely to shift that off the top spot this week, looking at the data front. Of course we did get German Q4 GDP numbers this morning which were in line, and frankly at 2.1% looking pretty solid to me. Later on this week we’ll get some CPI numbers for the Eurozone as a whole, as well as GDP data for the UK, but as with the UK general election last year there are few things with the potential to affect the major currencies like the referendum and that’s all the way in June. Truth be told, after a while we’ll all become used to the noise and pay less attention to it, barring new impactful revelations, until perhaps the last few weeks before referendum day, when investors will start to pay closer attention to the polls. Whether we assign as much credibility to the polling firms as we would have in the past, before last year’s disastrous pre-election analysis is a difficult question to answer. After all, are the ‘ins’ more likely to be targeted for polling than the ‘outs’? What impact will such things have on the accuracy of the predictions? I’ll let the polling firms sweat over those questions. The bottom line is that the outcome does have a significant potential to impact the destiny of not just the British economy but the political future of the European project. That should not be underestimated. We might focus on the pound sterling for now, but if Brexit did occur, mark my words the euro would likely come under fire as well.

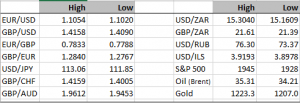

GBP/USD is as weak as it’s been for 7 years and perhaps more importantly the path opening up for a test of the 2009 lows which are just below 1.35. I’m not saying that we get there, but from a technical perspective there’s nothing really stopping the move. In fact looking at longer term charts it’s difficult for me to visualise a pattern which doesn’t see GBP/USD substantially lower than where we currently sit. Something to ponder….

It looks like the naira is stabilising for now, at a new normal around the 370 level (vs USD), a harsh lesson for those who may have sought to hold on in the hopes that sub-300 levels will soon be realised again. As things stand there is no new economic news, no constructive policy initiatives that point towards a strengthening of the Nigerian currency. In any case, such a thing would require a significant amount of time. The situation is certainly not helped by the fact that even as imported inflation must be rampant, the CBN has if anything lowered treasury yields. All in all, it’s not a great time to have cash sitting on deposit in a naira account.

Elsewhere risk sentiment continues to recover with the S&P very close to confirming a double bottom (see below) in recent sessions, and firmly move away from the wailing and gnashing of teeth that was the start of 2016. 1947 is a key level to watch on the S&P 500, a move above there should see the main US index rally comfortably back above 2000. It will be like the panic never happened. In conjunction with this equity market rally it is interesting to see that EUR/USD is also moving lower. The paradigm of positive risk sentiment and a strengthening dollar remains in force

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc