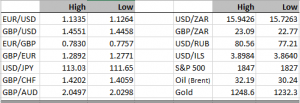

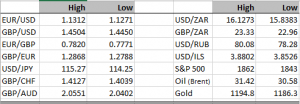

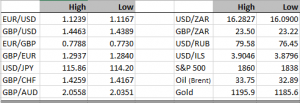

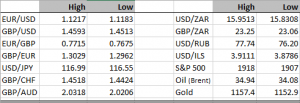

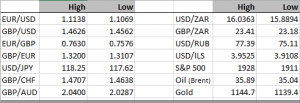

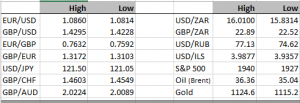

I’ve spoken to a few clients and friends who are getting panicked about the continued market volatility, but I’m still not feeling what they are feeling. The way I see it, this is an inevitable consequence of the Federal Reserve trying to ween us off central bank largesse. The fact that other central banks are stepping in to negate this seems to be getting missed, or perhaps reconfirms the primacy of the US central bank. From the peak of the Global Financial Crisis in 2008, the Federal Reserve had embarked on an unprecedented programme of liquidity that financial market participants came to depend on. Indeed, one might argue the implicit support of central banks goes at least as far back as the LTCM collapse in 1998, you’ll recall the “Greenspan put”, if you don’t, please google it. That era is over now, the Federal Reserve clearly wants to back away from it, it’s a risky course, no doubt, but it is absolutely necessary if the global economy ever wants to put the crisis behind it. The panic we are seeing now is because financial market participants are afraid that the world isn’t ready for it, but the US economy is on a solid footing, so I have to ask.. if not now then when? As it happens, I believe the Federal Reserve is pursuing a rational course, it was never going to be easy to clamber out of the pit central banks are largely responsible for creating. From a technical point of view, I think that this sell off is close to exhausting itself, there are signs of positive divergences in a number of key indices, I see it particularly in the chart for the S&P 500. It looks to me that we are at a point where greed should be the modus operandi of the truly smart investor, as Mr Buffett has said in the past, “be fearful when others are greedy, and greedy when others are fearful”, smart words! It is however interesting to note, that the old dynamics are really starting to play their part again. In this recent flight to quality gold has rallied, as have both the Japanese yen and euro, this is normalcy I’m happy to see! For a while there gold in particular was an unloved asset, but perhaps it’s coming into its own again, a true safety asset.

On this basis, I am expecting the S&P to start rallying soon, and this could be a rally founded upon true fundamentals and not central bank inspired monetary largesse. This would be a clear sign of health. There are however huge risks, and as I said earlier there are dangers for the Federal Reserve in embarking on this brave but necessary course. It would surprise no one if they pull back from further rate hikes this year, as more tightening might be too much for the global economy, but if markets do become bullish again the Fed might quietly steel themselves and go for it. A bitter pill for the rest of us, but good medicine is never pleasing to take. I am also looking for EUR/USD to turn lower again, I am not sure what happens to the Japanese yen though, and USD/JPY.

This doesn’t mean that other assets will recover, there are very real problems facing the Russian economy, the Nigerian economy and frankly the oil & gas sector generally. But even that gloomy news has its own positives, you only have to look at how strongly the Indian economy is growing (even if the numbers are suspiciously good), to see how oil importing economies are benefitting from lower energy costs. I expect cheaper oil to be the backbone of a possible reacceleration of growth in the US later on this year. Going back to Nigeria though, the situation gets worse and worse. Yesterday the naira saw another record low (see the chart below). In the absence of a credible FX policy and constructive economic policies in general I don’t see this trend improving.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc