If you needed any confirmation that things have been tough for the global economy in recent quarters, look no further than the horrific trade data published in China overnight. Chinese exports fell over a quarter from a year earlier, the worst such performance since the dark days of early 2009. Now undoubtedly there are seasonal effects because at this time of the year we have to be even more cautious about Chinese data due to the data disruption of the lunar new year. But we must acknowledge that the trend is extremely concerning, and in a way it’s less about what the impact is on China, and more about what it implies is happening to the rest of the world economy. Interestingly the rate of decline of imports into China slowed. Not exactly a sign of robust health, but at least the domestic economy is showing some stabilisation/resilience. One thing’s for sure, things don’t look rosy for the Chinese currency.

It seems that economists are starting to come around to my way of thinking. Increasingly experts like the former chief economist of the IMF, Olivier Blanchard, are saying that current fears about the global economy are not in line with the facts on the ground. An argument I have persisted with for some months. Yes, global growth has been unspectacular, but this isn’t the global financial crisis. The largest economy in the world, the US economy has been solid, and the UK isn’t doing too badly either. Several emerging market economies are already at what one could describe as their troughs. If anything the possibilities for a better tomorrow exist in many places. Granted China, Japan and the Eurozone are areas of concern, but even in Europe it’s hard to see a return to the crisis period of a few years ago, and all these economies are likely to act in a way that boosts activity. And hovering in the background is the silver lining of lower energy costs which should increase consumer disposable incomes in the coming months. This doesn’t mean that things are going to be wonderful, but there is no reason to my mind that things should get much worse from here. At least I haven’t seen the evidence yet. Should that happen, I reserve the right to change my tune!

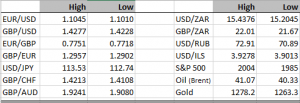

Looking at currency markets, it seems to me we have entered a period of corrective/ counter-trend markets which give the illusion of stability. In my view the dominant trend remains a stronger dollar, and new lows are likely for both EUR/USD and GBP/USD. Whether that paradigm remains into the end of the year however is an entirely different matter. For now, my thinking is that after this correction we will re-test dollar highs before a bigger correction in the dollar reveals itself. I will of course continue to monitor the underlying technicals of the market and should the view change we will update you.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc