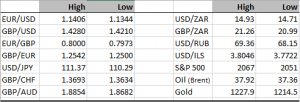

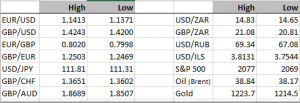

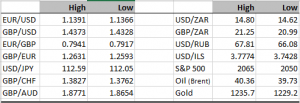

As I noted yesterday, there are signs that the run of poor economic data is starting to turn around, ironically just as the IMF and others are issuing dire warnings about the fate of the global economy. Overnight China published trade data that was dramatically better than expected….on both sides. Exports were up 11.5% when economists had forecast a rise of 2.5% and note that for the prior month exports had been down 25.4%. On imports the fall was 7.6% when economists had expected a decline of 10.2%, and noting that imports were down 13.8% in the previous month. All in all a nice positive surprise. I’m uncertain at the moment if distortions have arisen because of the lunar new year, but I’m just going to mark this down as what looks like the start of a turn around. Perhaps we shouldn’t be too hasty about selling our dollars, if the news keeps improving Fed rate hikes will be back firmly on the agenda!

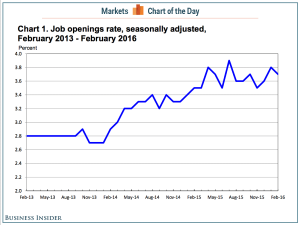

Another piece of good news has been the recovery in the oil price which is getting more and more attention. It’s good news because at the margin it seems that the positive impact of lower oil prices on consumption is not as great as expected (probably due to the combination of interest rates already at the lower bound), and at these levels some of the oil & gas sector debts which could have become toxic just might be survivable. The lowered probability of systemic failure from oil & gas defaults is a definite positive for risk sentiment and the equity market has been quick to pick up on it. It wouldn’t be a surprise if we see new year-to-date highs today or tomorrow. For sure it looks like equities are all set to break higher.

These positive news items provide the perfect environment to enable the macro community to move away from all the gloom and doom returning to expectations of a continuation of the global recovery. I’m not saying it’s going to happen, but the less worried we are about global growth, the more robust the dollar should become. Even the Japanese yen has retreated against the dollar this morning. It’s not a trend yet but it could be the start of one…

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc