Morning

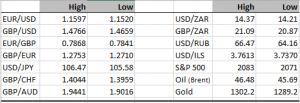

| High | Low | High | Low | |||

| EUR/USD | 1.1494 | 1.1470 | USD/ZAR | 15.04 | 14.74 | |

| GBP/USD | 1.4530 | 1.4490 | GBP/ZAR | 21.84 | 21.34 | |

| EUR/GBP | 0.7928 | 0.7904 | USD/RUB | 67.30 | 65.26 | |

| GBP/EUR | 1.2652 | 1.2614 | USD/ILS | 3.7983 | 3.7769 | |

| USD/JPY | 107.23 | 106.87 | S&P 500 | 2062 | 2050 | |

| GBP/CHF | 1.3922 | 1.3870 | Oil (Brent) | 45.82 | 44.67 | |

| GBP/AUD | 1.9460 | 1.9317 | Gold | 1283.0 | 1277.0 |

Just when you thought it was safe to get back in the water!!!! Not

Chinese PMI published a few hours ago and I am afraid to say things are still not great. PMI dropped from 52.20 to 51.80 which led to a selloff in Equity markets. On the flip side, the RBA announced some positive data with March retail sales and new home sales (though the AUDUSD remained side-lined trading just sub 0.7500).

Tomorrow we hear from the FED how NFP performed. Economists and pundits looking for a rise to +250k (from +215k previous month). The FED are hoping they are right too given what FED chairwomen Yellen has noted previously that US rate hikes are “data dependent”.

The USD will in all likelihood trade sideways to stronger over the next 24 hours if the predictions for NFP tomorrow turn out to be true. While the USD has weakened somewhat over the past fortnight, I think the rally (EUR) could be coming to an end, for now. I certainly do not believe we will suddenly see the USD rally back through 1.10 (EURUSD) given the delays and comments from the FED/FOMC. There needs to be a consistency of terrific economic data from the US (and China for that matter) if we are to see a move by the USD to rally towards PARITY. Needless to say I think we are a few months out.

Now, US elections will compound the FED’s decision on when to act. It looks like a HILLARY vs THE DONALD fight to the finish line. What the FED are unlikely to do is act in a way that could “skew” the election to either candidate. For this reason I would say that the FED’s next meeting 15 June will be do or die….following June there are meetings on 27 July, 21 September, 2 November and 14 December – so you can see my thought process. Maybe just maybe they could push for a July hike (and December) if all looks good. But think about this, say we start to see consistent (not awesome) data from the US but China still lags and growth falls. Can the FED really be seen to hike rates in the face of a global slowdown? I am ignoring the UK and EU for now as they seem to be trickling along nicely. The FED must act only if they feel and see both China and the US are growing. It is like hoping on one leg in a sack to the line, you are bound to fall and hurt yourself.

The GBP – volatility levels remain sky high….check this out:

1m 9.90/10.45 2m 14.25/15.25 3m 13.15/14.15 6m 11.35/12.30 1y 10.35/11.35 – I have been in the business along time and I cannot remember a time when GBPUSD vols traded with not only such a skew, but more importantly such a spread. This just goes to show how NERVOUS option traders are about the Referendum and what will happen after. With hope the UK will stay in the EU, and we can get on with our lives. Volatility will collapse following the result (REMAIN wins) but if LEAVE wins….FX markets will experience what I believe will be something like 16 September 1992 when the Conservatives withdrew the GBP from the ERM. The GBP will get absolutely positively mauled to the bone.

Be strong and have a good day

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com