Not unexpectedly the FOMC statement indicated that rates would be kept on hold. If there’s one key takeaway from the statement it is that the Federal Reserve is now clearly in wait and see mode. Mixed economic data, jobs growth slowing, inflation contained even if rising, anaemic growth elsewhere and the looming prospect of the EU referendum in the UK next week are just some of the factors which supported the case for a more cautious approach. Guidance for growth in 2017 and 2018 has been trimmed, although somehow the FOMC members still believe that further rate rises are on the table for this year. Still, the terminal rate after the hiking cycle is now expected to be lower than in previous projections, which to my mind is simply a case of the FOMC getting closer to what the bond markets have been telling us for some time. 2 year bonds are yielding less than 0.70% and 10 year bonds are yielding barely over 1.50%. Clearly this hiking cycle is not expected to be too aggressive.

I wonder if ‘Leave’ campaigners in the EU referendum were paying attention. They might feel entitled to accuse the governor of the Bank of England of political bias because of his warnings about the consequence of Brexit, but will they feel brave enough to say the same about Janet Yellen? She too is concerned about the potentially negative impact on an already weak global economy. At a certain point, when enough independent experts present a consensus about adverse consequences, will the voters in the UK take note? We’ll find out soon enough, the referendum is now only 7 days away.

Back to the FOMC, here’s a snapshot of the market reaction before and after the announcement.

First a short term chart for EUR/USD…

And here’s the S&P 500…

The lowered probability of rate hikes really puts a dent into any bullish dollar view, and not surprisingly the dollar has been a big loser out of all of this. You can see that in the dollar basket DXY, and it’s clearly visible in USD/JPY which has broken through a support level I’ve been watching for a while. Now looking at the longer term chart, a major support zone is under threat, and probably Prime Minister Abe’s economic plans as well.

Over the next few days Brexit is likely to dominate the currency markets with traders already widening spreads in anticipation of significant volatility ahead. GBP/USD and EUR/GBP are the obvious currency pairs that will receive special attention as the most liquid sterling crosses, but the entire GBP complex will be under pressure. You should factor that in when considering your currency needs.

Elsewhere the Nigerian central bank (CBN) finally released information about its plans to move towards a more flexible exchange rate regime. You’ll know that for the past year we have been insisting that such a move was not just necessary, but inevitable as well. Reality has finally caught up. Reading through the details it looks like the plan will be a sort of managed or dirty float, in comparison to the fixed exchange rate that has been in place for some time. In this type of regime there is less pressure on the central bank to intervene in the FX markets, as there are no bands, or fixed points to defend, so this should aid the CBN in its attempts to stop the erosion of its reserves. CBN has indicated that plans are in place to select about 10 primary dealers who can trade with the central bank when there are large deals in a system that is intended to make the market more transparent and price competitive. This is all welcome news and should greatly improve the signals that pass through to the wider economy. However there are still some restrictions in place which are likely to cause distortions to the market: the 41 imported goods and services which had been banned from accessing the interbank market remain, and Bureau de Changes continue to be barred from the interbank market. This is a real pity, and frankly it’s surprising that President Buhari continues to believe that restrictions like this which cause distortions and thus create avenues for patronage are compatible with his laudable aims of eliminating corruption from the Nigerian politico-economy.

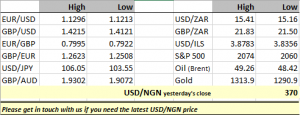

So what does this all mean for the naira? This is a huge step in the right direction and will go some way to eliminating the concerns that foreign investors have had about Nigerian economic management. It’s entirely possible that some might be lured back in to the debt and equity markets – certainly the positive reaction from Nigerian stocks might be an indication that at least some speculators believe that this will be the case. These changes are due to start next week on 20th June, and as Reuters put it, the naira will trade somewhere between 197 and 370! I think that unquestionably this will eventually lead to some currency appreciation, but do bear in mind that there’s a lot of pent up demand for foreign currency in Nigeria. To begin with, I suspect that traders will be patient and look for better levels to buy dollars. With the distortions that have been kept in the market we aren’t likely to get full transparency, but it should be a more comprehensible market with hopefully a little bit more two way risk. The reality is that the naira is likely to find a level around the 300 level, perhaps even the high 200s in the months ahead. What will be even more interesting will be plans to develop a forward/ futures market to trade the currency. This will require a deeper more transparent short term yield curve and we will study the evolution of this and report back to you when we are able.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com