We have seen a substantial decline in the pound sterling versus almost every other currency since the Brexit vote.

First we saw the collapse in the immediate aftermath of the vote, as the market was caught completely offside. As we all know, the final polls indicated that the ‘Remain’ camp would just sneak a win, but that wasn’t to be, and panic was the dominant theme in the market.

After the initial fall which continued on for another day or so, the market attempted to recover, but the selling pressure has been persistent. Clearly we all need to re-assess the prospects for the UK economy in light of this historic decision, but is that what’s driving the market now? Watching the rather toxic politics affecting the major parties in the UK, I am coming to the conclusion that the market is still terrified of the unknown.

In this case the unknown is whether Article 50, which initiates the process for an exit from the EU will be triggered or not. In theory, at least, this is not a certainty as the referendum is not by itself binding, only advisory. But it’s hard to believe any political party, not least the Conservative Party (with its history of Euroscepticism) would dare to go against the expressed will of the electorate. It seems to me that we are likely to continue to experience uncertainty until a new leader of the Tory party has been selected, and their strategy for dealing with the aftermath of the referendum is known.

As things stand that new leader should be Theresa May, the current Home Secretary, but we’ve been here before haven’t we? And I’m not even referencing the Brexit vote. Last year, after Ed Milliband’s failure to win the general election for the Labour Party, he stood down and left the way open for a new leader. No one expected Jeremy Corbyn to be the winner, but here we are. In opposition to the Labour Members of Parliament’s wishes, the wider party members voted for as left wing a candidate as could be found. Now, with a choice of the known and experienced Theresa May, who voted to remain, and Andrea Leadsom, a woman with very little front bench experience, who voted to leave. It is entirely possible that the rank and file of the Tory party might do a “Labour”, voting with their hearts and not their heads. This is exactly the sort of choice that could end up costing the Tories big. Yes the UK, has a parliamentary democracy and therefore the Tories would not be obliged to hold a general election, but it is questionable how much of a mandate a Leadsom premiership would have. Such a choice carries with it a substantial risk that the Conservative Party could be seen to have lost its electoral mandate only a year after winning power. It is entirely possible that, despite this risk, a calculation is made by the rank and file that the Labour Party is in such disarray that it doesn’t matter. They might be right. But calculations like this don’t exist in isolation and could well end up being the catalyst that sees the Labour Party get its act together and a more electorally palatable candidate like a David Milliband could be sitting across the floor in the House of Parliament in no time at all. The Tories would be wise to consider this.

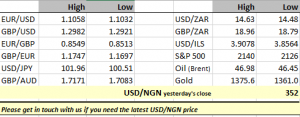

So what does this all mean for the currency markets? As of right now, this move, when you look at GBP/USD (see below) or EUR/GBP looks stretched.

But I hesitate to say this is the end of it. We often see, during the most powerful trends, currencies persisting in extreme oversold paradigms for longer than one would normally expect. There is absolutely no reason to think this is not one of those times. I am therefore very cautious of viewing the market on a purely technical basis, the fundamentals (and in this case that means the politics) must be a guide. Until we have more clarity on the leadership of at least the governing party in the UK, it is too tough to say anything other than we believe the pound will continue to trade poorly. Bear in mind that after Carney’s post-Brexit speech he indicated that rates were likely to come down this summer. Later this week we get the MPC, and markets are pricing in a 75% probability that we’ll see a cut. Even if sterling is due a bounce, it’s likely to only occur after the decision…

Lest we forget the rest of the world there’s much more to discuss in coming blogs, not least the stunning turnaround in labour market data in the United States and a sort of Tobin tax on steroids in Nigeria. Watch this space

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com