It seems we should never under-estimate the capacity of the Conservative Party to make pragmatic decisions where their survival is concerned. Andrea Leadsom the lesser contender in the internal party election to select a new leader gracefully bowed out, recognising unlike the Labour Party that if, as a leader, you only command the support of a small percentage of your fellow MP’s how can your position possibly be tenable. I can only applaud her mature decision, and the markets did the same with a recovery in the pound sterling that continues this morning.

This is where it gets interesting. Mark Carney, the Bank of England governor, has been widely expected to cut rates at this Thursday’s MPC in response to the crippling uncertainty that’s been weighing on the pound. Does the quick resolution to the Tory party’s leadership question change things? I think it could. So what happens if he says that he’s going to take a wait and see approach? How will the markets react? The UK equity markets might not like it, nor indeed the gilts market, but if sterling has been sold on the basis that more monetary loosening is coming we might see a sharp jump in the pound. After all, as I pointed out in yesterday’s blog, under normal circumstances the pound sterling looks oversold. I’m not saying for certain, but there is definitely a risk of a bit of a nasty short squeeze if Governor Carney disappoints. Watch this space.

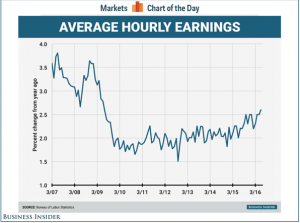

Last Friday we saw a very impressive bounce in labour market growth in the US after a few months of rather disappointing numbers. The consensus had been for 175,000 new jobs created, in fact there were 287,000 compared to 11,000 for the month of May. Interestingly the unemployment rate actually rose from 4.7% to 4.9%, but the U6 number – a broader unemployment number – fell from 9.7% to 9.6%. Perhaps the prior slowdown was a blip, but it will take a few more months of data to classify it as such. For now, this is a welcome data point for the market and policy makers to mull over. Will this have an impact on the Fed? Possibly, particularly when you also consider this chart from Business Insider..

Wage growth seems to be picking up. I don’t think this means the Federal Reserve will hike yet, there’s far too much Brexit noise around, but once that fizzles out, then tightening will very likely be back on the agenda in the United States. Bottom line, don’t get too bearish on dollars any time soon.

Elsewhere, in Nigeria, the central bank had warned that a new current account maintenance fee would be applied, and they were true to their word. Henceforth there will be a 1 naira fee for every 1,000 naira transfer between accounts. Let me put this in more comprehensible terms, if you have to transfer N10 million (~$28,500) you will be charged N10,000 (~$28.50). That’s 0.1% charge. It might not seem like a lot, but that is a huge amount of transactional friction. I appreciate that Nigeria is experiencing rather severe fiscal challenges with lower oil prices, but surely a tax that is likely to impact economic activity, or at the very least move money out of the formal banking system is a retrograde step. It really seems a case of one step forward and two steps back at the moment. We will have to keep an eye on the economic impact of this policy on the Nigerian economy, but clearly it can’t be for the good.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com