While consensus seems to be that UK equities will benefit from the Brexit induced fall in sterling, HSBC has stated that there could be a sharp reversal in to the end of the year with a forecast that UK equities will finish the year about 7% down from here. If global equities continue on with this powerful bull run, and bearing in mind that the FTSE 100 index is heavily populated with international stocks it’s hard to see how HSBC can be right on this. But it bears watching. One area where there seems to be agreement is the fact that UK equities should outperform European equities though.

Militants are becoming increasingly active in the Nigerian Delta region frustrating Nigerian attempts to maintain current production levels. The insurgents are a reflection of the anger felt in such a resource rich region where living conditions are fairly poor. I fear this is a state of affairs that is likely to continue unless a new settlement is reached to pacify the ethnic minorities in the Delta. Meanwhile the official naira rate continues to converge towards the parallel market rate. It is entirely possible that by the end of the year this process of convergence will be complete. We continue to believe that there’s a case for the parallel market to end the year much stronger than the current position.

The Chinese economy, at least according to the official data, appears to be chugging along with 6.7% GDP growth in the second quarter which is unchanged from the previous period. Government stimulus and a strong property market seem to be the main contributors.

I thought this was deliciously ironic so I couldn’t resist mentioning it, the US has now started to export gas to the Middle East. Yes, you’re not mis-reading, it’s actually happening! The Republican Presidential convention has started and Donald Trump is expected to set out his case later on in the week. This could be a key moment, as we will get to see if he can put forward an argument that can appeal to a wide enough section of the electorate. The convention has not been without drama though, with attempts by those opposed to him to disrupt the event. They weren’t successful, but this is a reminder that even within his own party there are those who are ardently opposed to him.

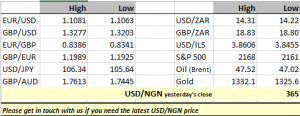

I’m not sure there’s much to say specifically about currencies today. After the frenetic trends of recent weeks, we appear to be in some sort of consolidation period. Sterling continues to be the focus, and this morning it has weakened a little bit, but still well within the range of recent days. We continue to believe that the case for more sterling weakness is the most compelling theme at the moment.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com