The ECB, like the Bank of England before them chose a cautious ‘wait and see’ approach to the post-Brexit situation. It’s easy to see why, there hasn’t really been any significant data announced yet that gives us a clear picture of what activity has been like after the referendum. Perhaps that changes this morning with a raft of European country PMI data to be announced in the next few hours. If as feared it signals a slowing or even contracting of economic activity then all eyes will turn back to the central bankers. Both Governor Carney and President Draghi stated that they are ready and willing to take action if circumstances demand it, so we will watch to see if this bad data will be enough to convince them of the need for action. Both central banks, it should be pointed out, are already at or close to the zero bound so their capacity for action isn’t what it was before the global financial crisis, but still, they will surely be able to do something. My guess is that the solution, from their perspective will involve attempts to weaken their respective currencies, so the likely reaction to poor data later this morning will be a stronger dollar and weaker euro and sterling.

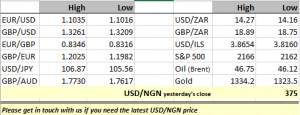

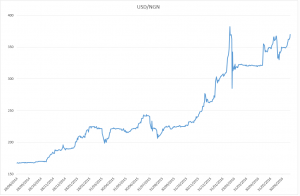

Elsewhere the dollar is already weighing on the Nigerian currency, the naira, following the publication of IMF forecasts for negative growth this year. It has been an extremely tough environment to sell naira in recent days as the chart below illustrates…

Finally, Donald Trump has officially accepted his nomination as the Republican candidate for President of the United States and gave a long, and sombre speech putting forward his case. One of the things I noticed was that he talked about ‘Americanism’ as opposed to ‘globalism’. In recent days he has talked about the US not necessarily supporting their NATO allies if there was ever conflict in Europe (Russia presumably being the threat in such a scenario). I can imagine that some world leaders are horrified by both of these points. All I can say, having observed the EU referendum, is that truth, particularly from “experts” or members of the elite or establishment is being ignored by electorates at the moment. What seemed like a publicity stunt a year ago suddenly feels very serious. It is ironic that his opponent, Hillary Clinton, as establishment and elite a personage as you could find, is probably precisely the wrong person to be waging this fight. The irony being that she may rightly be distrusted for many reasons, but the truths she will try to speak to defend America’s historic positions are unlikely to be heard because so many are unwilling to trust her. I await her speech at the Democratic convention, it will be interesting to see if she can put forward a case for hope, and an admission of past mistakes that will persuade enough of the American electorate to pull back from the abyss. Because as things stand, it seems that Trump can say what he wants and his followers will believe him, while Hillary will not be forgiven for any perceived untruths, that is one heck of an advantage.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com