Rather quietly the S&P 500 has exceeded last year’s record high and looks set to power on to greater highs. This fits in rather well with my bigger picture Elliott Wave count for the bull trend that began all the way back in March 2009.

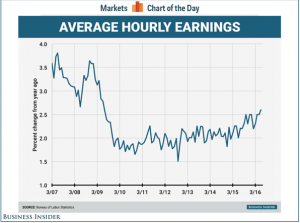

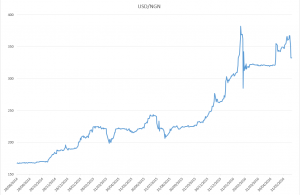

If my count is correct then we have quite some way to go before we need to worry. Obviously I wouldn’t be pointing this out if it didn’t have implications for the currency markets. As things stand it is clear that risk sentiment, while taking a very temporary hit from the Brexit vote, has recovered nicely, and looks sent to continue in positive fashion. Even more pertinent is the fact that policy makers are likely to be taking note of the market action and consumers will be buoyed by the positive wealth effects of the rally. Based on this, and the stabilising political situation in the United Kingdom, it is likely that in the coming months the Federal Reserve will again place monetary tightening firmly back on the agenda. If this is indeed the case then, we can expect the dollar to strengthen as the market starts to slowly price in an increasing probability of higher US interest rates. I wouldn’t be surprised to see stronger consumer spending on the back of the equities rally, and I should also add that it’s noteworthy that the rally kicked off on the back of the strong jobs data last Friday. That doesn’t feel like a market that’s afraid of higher interest rates to me.

Sterling continues to perform strongly following the resolution of the Conservative Party’s leadership contest, rallying almost 4% from the lows now. If that’s not enough there are signs that international investors are starting to look at opportunities to buy British assets on the cheap in the wake of sterling’s collapse. This is a sure sign that some now consider the pound sterling to be undervalued. A large US fund is rumoured to have had exploratory talks with the commercial property funds which were forced to reject demands by investors to get their cash back; and a South African retailer is looking at a takeover of Poundland a high-street discount store. As I mentioned in yesterday’s blog, there is an increasing risk of a fairly sharp rally in sterling, particularly if the MPC decides, on Thursday, that interest rate cuts are no longer on the table. But it’s important to note that as things stand, economists expect 3 of the 9 MPC voters to recommend a cut, this is in comparison to the situation in the last few meetings where voters have unanimously voted to maintain the status quo. Normality can return quickly after a crisis sometimes!

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com