On the face of it, the macro data continues to look rather shaky with Singaporean exports falling almost 8% year on year in April. Still this is a marked improvement on the prior month which registered a nearly 16% decline. I tend to think of Singapore as a global bellwether because of its incredibly open economy, so perhaps we can take this as a sign of stabilisation of some sort. Certainly China looks to be on the mend, but the Empire Manufacturing data published yesterday afternoon from New York paints a picture of weak manufacturing in the United States. Still I’m not too concerned at the moment, stocks bounced quite nicely off the support zone I’ve been watching and with oil on the rise, the risk of systemic issues in the oil and gas sector loans market looks to be receding.

We also got a negative inflation surprise from the UK this morning, with inflation significantly less than forecast. But again, when you tie that in with the bounce in oil prices it would seem to me that there’s less of a risk of disinflation in the near future.

It’s no real surprise that the politics is turning ugly in Nigeria following the raising of the price cap for petrol last week. The government is being criticised by economic pundits and labour unions alike. Historically the unions have responded to fuel price hikes with strikes and this time is unlikely to be any different, we are talking about an effective two thirds hike in prices after all. Let’s leave aside the fact that a huge percentage of the Nigerian population – the non-urban poor – doesn’t benefit from subsidised petrol prices, government is also being attacked because they still refuse to adjust the official naira exchange rate and have required fuel importers to access an already stressed parallel market. The critics may have a point about the exchange rate, but it’s hard to see how a fiscally challenged government could maintain the subsidies. It’s just a pity that these critics haven’t been more constructive in their opposition. As they say, it’s easy to sit in an armchair and criticise. The critics are correct though, this will just increase the spread between the official rate and parallel markets. At some point this has to be reversed and it’s hard to see how that doesn’t involve an official devaluation.

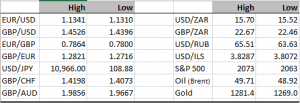

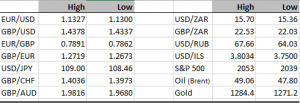

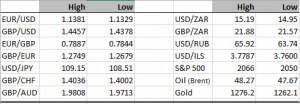

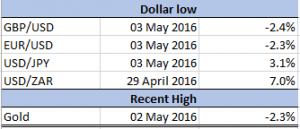

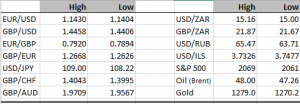

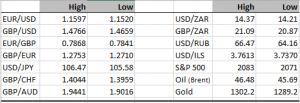

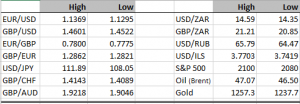

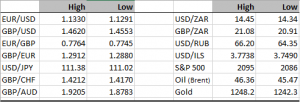

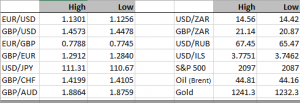

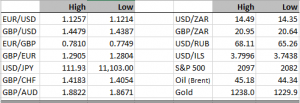

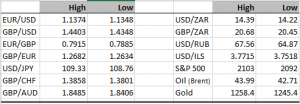

For now consolidation seems to be the name of the game for dollar crosses, but it is still our view that the next short term trend should see a stronger greenback.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com