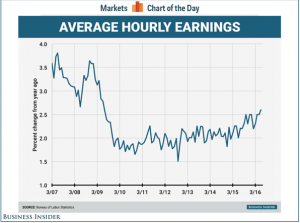

Equity markets continue to make fresh highs, some of them anyway, as risk sentiment remains on a robust footing. It certainly didn’t hurt that the UK economy got some welcome news yesterday, with the unemployment rate falling to an 11 year low. Bear in mind though, that data is a lagging indicator and is reflective of conditions that existed before the referendum vote. Wage growth remains anaemic though, and it would be hard to believe that current circumstances are conducive to further acceleration, considering the IMF’s recent downgrade of UK growth prospects.

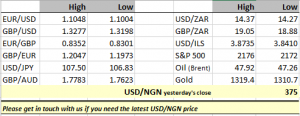

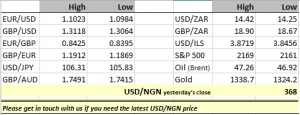

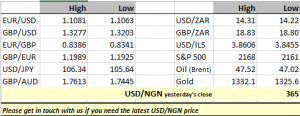

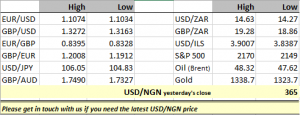

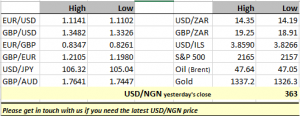

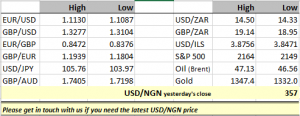

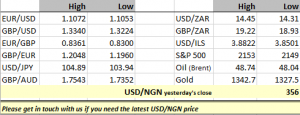

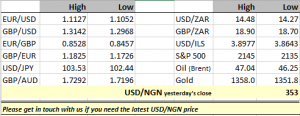

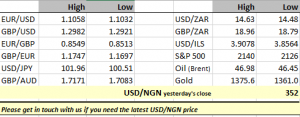

While sterling started yesterday under pressure, it managed to recover somewhat, and there is no confirmation yet that we are in the next phase of a downtrend. In fact this morning, both sterling and the euro are stronger versus the greenback. All we can do is keep watching and see if key levels get challenged. Indeed yesterday, sterling actually outperformed the euro, which traded in a very tight range versus the dollar, and this trend continues today. All in all, not a huge amount of excitement for the currency majors.

Today we get the ECB rate decision, and it’s quite likely that President Draghi will be forced to consider additional monetary stimulus following Brexit. Depending on what he announces this could inflict some damage on the euro. It’s worth noting though that even more quantitative easing poses a rather unique problem for the ECB. One of the guidelines for the national central banks regarding their sovereign debt purchases is a restriction against buying debt which yields less than -0.40% (yes the minus sign is appropriate), but in the case of Germany, where the Bundesbank has to buy the largest component of Eurozone debt, this restriction is becoming a problem, given the fall in yields after the EU referendum. What to do, what to do!

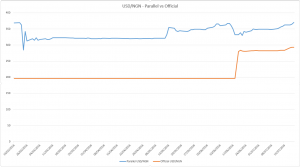

The IMF has been busy, and its work is one of gloom. According to the IMF, Nigeria’s economy is expected to show negative growth this year, and the naira has weakened in the wake of the announcement. The convergence between the official rate and the parallel market continues apace, and at the moment it seems to be the case that the official rate is doing most of the work.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com