| High | Low | High | Low | |||

| EUR/USD | 1.1170 | 1.1082 | USD/ZAR | 12.6442 | 12.5335 | |

| GBP/USD | 1.5307 | 1.5240 | GBP/ZAR | 19.31 | 19.16 | |

| EUR/GBP | 0.7302 | 0.7265 | USD/RUB | 57.16 | 55.42 | |

| USD/JPY | 125.69 | 124.99 | USD/ILS | 3.7897 | 3.7583 | |

| GBP/CHF | 1.4393 | 1.4329 | S&P 500 | 2,095 | 2,088 | |

| GBP/AUD | 2.0074 | 1.9974 | Oil (Brent) | 63.90 | 63.24 | |

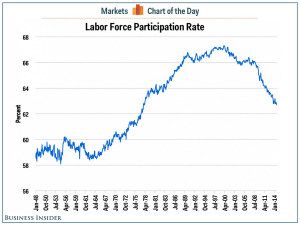

US employment data, in the form of the non-farm payrolls report, came out on Friday and it was generally impressive. But acting as devil’s advocate I would like to direct you to the chart below…

This chart illustrates one reason why some Federal Reserve policy makers continue to resist calls for higher US rates sooner rather than later. Now, granted this is an old chart, you can see that the participation rate (the percentage of the US working age population in gainful employment) is somewhere below 63% in early 2014. Well… it’s now the middle of 2015 and the participation rate published on Friday was 62.9%. So… no change in labor force participation over the last year then! For me, the fact that this chart has been in decline since well before the great financial crisis in 2008 speaks of more than cyclical concerns, I can’t pretend to be an expert on demographics, but there is a rational explanation for this, and there are certainly rational justifications for why interest rates in the United States are too low now that counter this statistic anyway.

In any case.. back to last Friday. 280,000 new entrants to non-farm payrolls, comfortably in excess of the 225,000 forecast, and perhaps more importantly average hourly earnings beat expectations as well. As I’ve mentioned this before, wage growth is likely to be the trigger for policy normalisation, and it’s starting to grow. Surprisingly however, the unemployment rate rose. This might be counterintuitive, but that is likely to be a positive, implying that more people are starting to look for work. The US dollar’s reaction was immediate and unequivocally positive, rallying close to 100pips within minutes against the major currencies. The big moves in the last few days have been in favour of the dollar, and we continue to look for the greenback to strengthen into the end of the year. EUR/USD parity is still a possibility, as is 1.40 in GBP/USD, but the path towards that will be fraught with bumps and potholes. We consider it our job, to keep our eyes out on your behalf, to look through the fog and warn you of what’s coming, we aim to do that.

On the other side of the world, there are encouraging signs that Asia is doing rather better than thought. Japanese Q1 GDP data has now been revised up to 3.9% annualised versus the 2.4% initially calculated. Business investment has been much stronger than expected, with activity recovering it’s groove after the hit from the sales tax increase. Additionally data out of Singapore and South Korea has been positive relative to expectations. No one is saying that this is where the next great growth drive is coming from, but this is a sight better than fears that Asia could even be a bit of a drag. In fact according to some recent ‘nowcast’ factor models from Fulcrum, China and Japan are both recording stronger growth than seen in some time, and even the Eurozone (as we’ve been pointing out) has been looking spritely, particularly the serial laggards of Italy and France. The world is not the place of doom and gloom it has often threatened to be. Which is why I find the intervention of the IMF last week a trifle puzzling (remember that they cautioned the United States against hiking too soon). But who can understand why some of these supra-national bodies do and say what they do sometimes. Perhaps it’s more about staying relevant.

What is clear, is that continuing gradual improvements in the United States economy will increase the pressure on policy makers to hike interest rates. As in all things market related, it’s the anticipation that matters, and the longer this goes on, the greater the attraction to the US dollar. We continue to strongly believe to be the case that over time the US dollar will strengthen against its major partners..

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc