The world is adjusting to the new realities, following Wednesday’s interest rate rise in the United States, its southern neighbour Mexico has followed suit with a quarter percent hike to 3.25%. When you consider the fact that inflation has fallen for seven straight months, you might consider the decision strange, but I believe Banxico’s concern relates to the 15% decline in the Mexican peso, and fears that this could accelerate if a firm stance isn’t shown in public. I doubt the Mexicans will be alone facing this type of dilemma. The larger more advanced economies are still able to plough their own furrow, and we can see that happening with the Bank of Japan, who seem to have made a complete fool out of me, it was only a few days ago where I remarked that the BoJ, following solid Tankan data and some other good data, would be in good position to resist calls for further easing. What did they do? They just effectively eased policy by agreeing purchase longer dated bonds and to spend more money buying equities. We’re not talking about a huge increase in stimulus, but it’s the symbolism that matters here. The Japanese central bank is keen to emphasise the seriousness of their attempts to spur investment and wage growth.

So we have a huge policy divergence shaping up in the macro world. On the one side we have the US Federal Reserve tightening monetary policy, with the Bank of England (despite current protestations) sure to follow at some point in 2016, albeit probably after what I’m guessing will be a serious weakening of the pound sterling. And then on the other side we have the ECB, the Bank of Japan and the Peoples Bank of China all easing monetary policy. This is a scenario that is fertile ground for substantial currency moves, and generally disruptive markets in 2016, and it’s clear that emerging market economies will be caught in the cross-fire. When you consider that 2016 will also be an election year in the United States combined with the disruptions in the Middle East, the slow boiling crisis in the South China Sea and any number of issues that could grab headlines, next year is shaping up to be one for the history books.

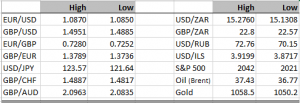

This morning at least we are seeing a small dollar reversal, but the trend is still clearly in the greenback’s favour. We continue to expect new highs for the dollar in the coming weeks and months.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc