As my colleague and fellow blogger has already observed, it’s been quite a start to the year. May I first take this opportunity, now that I’m back from sunnier climes, to wish you all a healthy and prosperous 2016. Sadly our concerns about 2016 could pose a threat to our collective financial health and prosperity! I thought it would be apropos to talk about some of the main issues for the year as I see them. I don’t claim the ability to peer into the future, but you don’t have to be a mystic to identify the main threats and opportunities for the coming year. Here are a few of them…

- Will the US Federal Reserve continue to tighten policy?

- Will the ECB continue to ease policy in the Eurozone?

- What can China do to avoid an economic catastrophe?

- Will commodity prices continue to collapse? And what outcome is more likely at this stage from lower energy prices, the boost to consumer’s disposable income, or the confidence sapping impact of job losses and abandoned capital investment in the energy sector?

These are all important questions, but it all boils down to one thing for us… what will this do to currencies?? I believe the Federal Reserve will hike 25bps a few times this year, because I expect the labour market to continue to tighten as the US consumer benefits from a halving of energy prices over the past half year, and the disinflationary impact of cheaper consumer products from a devaluing China. In my opinion the FOMC will be pre-disposed to look through the disinflationary impact of falling petrol prices as the unemployment rate dips comfortably below 5%. While there will be much gnashing and wailing at a stronger US dollar by exporters, this is likely to be overwhelmed by a pickup in wage growth as employment conditions continue to improve. I don’t believe the greenback will be on a one way trip higher though, in fact I think we are likely to see at least an interim high for the dollar in the first quarter of this year before a deeper correction occurs, however, even saying that, I continue to believe that we are in the midst of a multi-year dollar bull trend, and we will eventually see an even stronger US dollar. The risks to this view are all to do with events outside of the United States.

I am actually quite positive (in relative terms) about the Eurozone, we should see increasing evidence of the benefits of quantitative easing, particularly the competitive benefits of a weaker euro boosting even struggling Eurozone economies. However if, as I suspect, we see a correction higher in EUR/USD at some point in the middle of the year, along with blatant efforts from China to weaken its currency, I suspect the ECB will look to ease monetary policy further. Let’s not kid ourselves folks, all these guys want to do is weaken their currency, it’s a “beggar thy neighbour” type policy and they are all trying it, apart from the United States which is moving on from this strategy.

Talking about the Chinese, it’s entirely possible that the economic distress there is even worse than we think, it’s really difficult to analyse the published data, but as I’ve already alluded to, currency weakness is an obvious palliative. The problem is, that when we are concerned about China, we can’t just focus on the Middle Kingdom, we have to look at a swathe of commodity producing emerging market satellites whose fates are inextricably linked to the fate of the Chinese economy. Think Africa, think South America, even the Middle East via the commodities linkage, all of these regions have become highly dependent on the Chinese commodities consumption binge and will continue to suffer the consequences of enforced cold turkey. These are where the unknown unknowns are. These are where the risks that link back into the global financial system and throw everything into chaos are likely to reside. In the mid-1990s, Mexico was the first big victim, this time around Brazil could be the one to watch out for, even if there is an Olympics in Rio! We can’t know how bad things might be as a result.

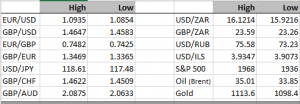

The bottom line is that I expect dollar strength to persist for a while, but a messy correction is almost inevitable at some point before the bullish greenback trend re-asserts itself. We expect emerging market currencies will continue to have a tough time of it in 2016.

Today we’ll get to see the first truly significant data of 2016, the US labour market data release, non-farm payrolls. Economists are forecasting another 200,000 new jobs created, but we should also pay increasing attention to the average hourly earnings number. The FOMC will be watching inflation closely and that is as good as any data to capture accelerating wage demands in the United States. The dollar has actually been weakening a bit in recent days against the Japanese yen and the euro, but the pound sterling has remained very weak. So far this morning the dollar has rallied against the yen and euro, but struggled against the pound sterling. I suspect that we could see a little bounce in GBP/USD today, barring any outlier result from the labour market release….

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc