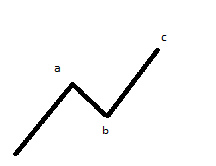

Crude oil looks to be starting the 2nd upswing of its recent recovery, what we Elliott Wave practitioners would call wave ‘c’ of an ‘ABC’ correction (see illustration below). The obvious target for this correction could be just shy of the $36 level, but this bounce is unlikely to be more than a temporary respite for the commodities complex. After all, Chinese demand still looks tepid, and producers are putting an increasing amount of supply into the market. Hardly grounds for short term optimism.

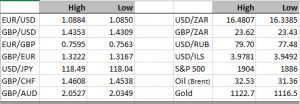

In fact looking across assets there do seem to be recoveries happening everywhere, whether you look at GBP/USD or the S&P 500 index. It’s been a very bearish start to the year and days like this are bound to happen. This is a chance for emotion to be taken out of the equation and more fundamental reasons can try to assert themselves as drivers for market prices.

Later on today we get the first FOMC announcement of the year. There have been increasingly strident voices calling December’s rate hike a mistake. There’s no doubt that some of the uninspiring US domestic data could justifiably be used to challenge the wisdom of the Federal Reserve’s attempt to draw a line in the sand on the zero interest rate policy (ZIRP) era, but it was only a 25bps hike. What could be at risk is the Chairwoman Yellen’s statement that more rate rises are likely in 2016. This is what I believe we should be on the lookout for. I very much doubt that there’ll be much of a retreat in this meeting. Sure we’ve had a bit of a market wobble, but growth is still positive and no one seriously believes the United States is going to dip back into recession. There is no reason whatsoever for the Federal Reserve to risk its reputation by a very public and embarrassing reversal. What there could be is some sort of concession hidden deep in the wording that officials use and that’s what everyone will be on the waiting for. If that were to happen it could halt the bullish dollar trend and create more market volatility. Personally I’m not expecting much excitement at all.

Elsewhere the central bank of Nigeria kept rates unchanged yesterday, and reiterated its commitment to the current fixed exchange rate band of N197/$ (+/-). The parallel market has widened away substantially from that level and is currently slightly weaker than N300/$. How sustainable this stance is by the central bank is open to question. Many things are open to question! The most obvious parallel to the FX policy we’re seeing in Nigeria at the moment is in Venezuela, if that doesn’t give anyone pause for thought nothing will. We can only hope that economic and market realities win the day at some point in 2016, but the argument that a weaker currency is harmful to businesses really doesn’t wash. What possible incentive does any business have to focus on its core competence if they are able to roundtrip FX and generate superior returns to anything their core business could achieve? A discussion for another day perhaps.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc