GBP/USD has dipped below the key 1.40 level, and the question now is how much further can it go? As I wrote in yesterday’s blog I am struggling to identify a likely near term support area other than the 2009 reaction lows in the 1.3498 – 1.3653 a. I’m not saying we get there, I just struggle to find a reason why we won’t. It is certainly reasonable to assume that the pound will remain under severe pressure as long as the UK’s membership of the European Union remains in question. I would point out that this doesn’t mean that the pound sterling needs to continue its decline right up until the referendum date in June, because if it becomes clear that there is strong support for continued membership or indeed exit, then certainty will return to the market one way or the other. In many ways the unknown scares the market even more than the actuality, and this will be the main problem in the weeks ahead.

We got some positive data out of Singapore last night, Q4 quarter on quarter GDP was much better than expected and in fact better than the data from the previous quarter. Why is this a big deal? Well… maybe not a big deal, but I tend to think of Singapore as a ‘canary in the coal mine’ type of economy. It’s extremely open, and it’s very exposed to the global economy. If Singapore is starting to perk up it’s more than likely to be due to improvements in the global economy rather than something specific to the tiny domestic market. At least that’s my thinking. Anyway, one data point is not sufficient to say anything definitive, but perhaps it’s an alert for us to start keeping an eye out for more positive data to come out of larger more globally impactful economies.

A couple of FOMC members will be giving speeches later on today, I’ll be keeping my ears open in case they reveal new insights to current Federal Reserve thinking on monetary policy. For me though, more interesting will be the Bundesbank President Weidmann’s speech. I don’t believe his public talk will be related to monetary policy, but it’s not beyond the realms of possibility for the press to ask questions related to Draghi’s recent utterances regarding extending quantitative easing. Needless to say we will let you know if anything is said that could impact the major currencies.

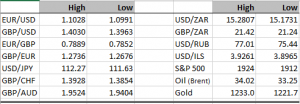

I think it’s worth pointing out that sterling has not been on its own in its recent lurch lower. While for obvious reasons the British currency is capturing the headlines, the euro has been steadily weakening against the dollar as well. In the last two weeks EUR/USD is 3.5% weaker. I wouldn’t call this a dollar move though, as the likes of the Japanese yen and Australian dollar have been on an appreciation bias. This is the type of market where traders need to earn their corn and identify the themes driving the market. Is it country specific, related to rates markets, commodities etc. I have nothing wise to say in that regard at the moment, but I’ll expand on my thinking and communicate that to you in coming blogs.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc