I suspect that economic historians will be talking about what has been happening to the yen and the euro since December, both of these large currencies are currently backed with negative interest rates and yet they are some of the best performer’s year to date. This flies in the face of what most (certainly their respective central banks) would have expected, and explanations for why the opposite is happening will be the thesis of many an aspiring P.H.D I’m sure! Even after coded warnings in recent days by Japanese officials (Japan has a long history of currency intervention lets not forget) the market has continued to buy Japanese yen to such an extent that at one stage yesterday USD/JPY was down almost 2%!!

As long as USD/JPY is able to stay below 110.70 I suspect we will see the currency pair test lower lows, 105 looks easily within reach, before another bout of yen weakening starts. That’s my view with a technical hat on, and I believe the moves we’ve been seeing will be hard to stop as it feels like investors capitulating out of the very bets the BoJ and Prime Minister Abe have been encouraging. This move feels like it’s all about the pain! Intervention would only help people get out of losing positions, it wouldn’t encourage them to jump back in at this point.

Elsewhere the chronic weakness of sterling continues and we still have months to go before the referendum. Clearly there’s more to this than Brexit fears but it’s definitely a part of the equation.

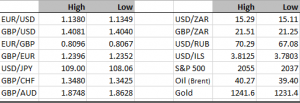

Thematically risk assets are off to a great start today, you only have to look at currencies like the Russian rouble and South African rand which are much stronger on the open, or the fact that crude oil is already up 2% this morning after rising about 5% a few days ago. In the short term this feels like 4 or 5 years ago where risk rallied as the dollar weakened. I don’t think this is a paradigm shift, but we’ll have to keep an eye on things and see if the pattern justifies further analysis. For now despite very short term considerations, the major trends are for a weaker pound sterling (despite the good start this morning), stronger Japanese yen, and a gradual retreat of the US dollar.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc

Just desire to say your article is as surprising. The clarity in your post is just spectacular and i can assume

you are an expert on this subject. Well with your permission let

me to grab your feed to keep up to date with forthcoming

post. Thankms a million and please keep up the rewarding work.