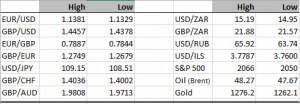

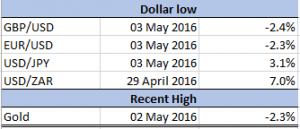

Don’t look now, but the greenback is getting stronger. Since the beginning of May there’ve been signs of this. I believe in a recent blog we even mentioned that key levels were being approached in some of the major crosses that could be the optimal points for reversals back into trend. At the time, USD/JPY was the critical currency pair as it was right at the limit of where I thought it should get to, and it duly bounced and the dollar has been appreciating versus the Japanese yen since. I’m already thinking of that 105.55 level as a confirmed key support area now. Any move through that could well fatally damage my conviction in the dollar bull trend. In any case here are some of the interesting movers, you’ll note that the moves are quite decent. I’ve included gold for 2 reasons, (i) it’s not unusual to see gold weaken as the greenback strengthens, so this looks consistent with the thematic move, and (ii) if recent stock market moves were really of such concern, then perhaps gold’s use as a store of value should have aided it over this period, but there is no sense of negative risk sentiment in the air.

The Brexit debate is hotting up. Bank of England governor Carney was at it again, warning of the risks of leaving the EU. In his view this will be very bad for the UK economy, and the word is the IMF is going to come out with a statement soon supporting him. The Brexiter’s might rail at this as political interference, but let’s not kid ourselves, if he came out with analysis that it wouldn’t impact the UK economy they would be shouting it from the rooftops. All of this took centre stage and it’s easy to forget that Carney’s comments came after yesterday’s MPC vote, which remains unchanged. All 9 voted to hold. As we’ve observed many times before, there’s very little likelihood in a change of stance from the BoE for the foreseeable future. Don’t count on sterling going on an appreciation trend anytime soon.

Some hugely significant news from Nigeria. I’ll simply copy what I’ve been sent here:

“The Nigerian government will deregulate the domestic pump price of imported gasoline in a bid to encourage private marketing companies to import more, minister of state for petroleum Emmanuel Kachikwu said late Wednesday, as the country seeks to end months of crippling fuel shortage.

Kachikwu said on state television that the national fuel pricing regulatory body, the Petroleum Products Pricing Regulatory Agency, would announce Thursday a new price band not above Naira 145/liter ($0.74/liter), which fuel marketers would not be permitted to exceed.

“In order to increase and stabilize the supply of the product any Nigerian entity is now free to import the product, subject to existing quality specifications and other guidelines issued by regulatory agencies,” Kachikwu said.

The government previously maintained a regulated price of Naira 86.50/liter for gasoline, but private marketers said this was not enough to cover the cost of imports, which had already been hiked by tight access to foreign exchange as well as high bank charges.”

About time I say! I was actually expecting something like this from the Buhari administration just after the inauguration last year. But one thing that we’re learning about President Buhari is that he takes his time. There’s nothing wrong with a deliberative executive, as long as he’s trying to move the country in the right direction, he should be applauded for this. It has always been an embarrassment for the largest oil producer in Africa to be crippled by queues at petrol stations. I suspect this will eventually drastically reduce that phenomenon. The naira took a hit with fall of over 5% yesterday. This is a new dynamic that is likely to put consistent pressure on the Nigerian currency as new entrants into the refined products market scramble to buy dollars to make purchases. But that’s ok, in the longer term this will make it far more profitable for private firms to invest in refining capacity in Nigeria and this will be of benefit for the naira in the years to come.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com