Mixed news for the oil sector. Just as Goldman Sachs upgrades its short term outlook for oil, Moody’s downgraded Saudi Arabia’s credit rating. Supply disruptions in Nigeria coupled with robust Chinese demand have helped the recovery in prices which are now up 70% from the lows at the start of the year. Quite a remarkable turnaround, but too late for Saudi Arabia, where Moody’s is of the opinion that the fiscal situation and higher debt makes the kingdom more vulnerable in the longer term. I remain sceptical about how much further the rally in oil can go, but if the Chinese government has been able to stabilise their economy perhaps we will all need to re-assess not just the oil sector but the global economy’s prospects as well.

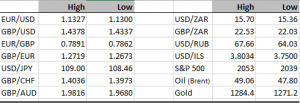

While all this has been going on the greenback is quietly strengthening across the board. Looking at the majors like EUR/USD, GBP/USD and USD/JPY the pattern is the same, for the last few days the pairs have shown signs of consolidation. These patterns are fairly typical, and normally end with a move consistent with the preceding trend – dollar up. This is what we’re expecting in the next few days. I would be surprised if we don’t see GBP/USD below 1.43, EUR/USD below 1.12 and USD/JPY above 110 (see below). We see a similar situation in a lot of emerging market dollar crosses as well.

It seems that the period of stability for the naira is well and truly over for now. Setting aside the recent supply disruptions which have pushed output down to a 20 year low (Chevron and Royal Dutch Shell have had to shut down production at a number of sites), the move last Wednesday, which we reported, to end petrol shortages has had a negative short term impact on the naira. And it just got worse this morning. The naira has now weakened 11.4% over the last week! We believe this to be short term turbulence in the wake of what is a hugely significant and warranted policy shift. This is a move to eliminate subsidies and in time the market for refined products will start to clear more effectively, and we should no longer see queues for petrol in Africa’s biggest oil producer. This is the short term price that needs to be paid.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com