Later on today the FOMC will announce their rate decision for June. This has been widely anticipated and while there are concerns that the Federal Reserve is still trying to maintain their positive outlook on the US economy, it seems increasingly likely that they will opt for caution. We’re a weak away from the EU referendum in the UK, an event that could spark significant volatility, it’s hard to imagine the FOMC being so incautious as to hike now, and be forced to retreat if a ‘Leave’ vote sparks substantial global volatility. I’m not saying that’s going to happen, in fact I still think that the vote will be to stay in the EU, but just thinking about what keeps central bankers up at night, being forced to reverse a recent decision has to be very high on the list. It’s not as if the US economy as hitting the ball out of the park at the moment. Frankly I would characterise the economy in the United States as being better than most, but what does that really say in a world of anaemic global growth? So in summary, at a pinch, I don’t expect the FOMC to announce a hike. I’m actually more interested to see what the statement says. We will of course bring that to your attention in following posts, and discuss the implications for the currency markets.

8 days to go before the EU referendum and sterling looks to be taking a bit of breather so far this morning. It’s been a frenetic weak with substantial declines versus the euro and the dollar. A recovery of some sort certainly seems appropriate, and I am biased towards this, but as ever the new polls are likely to have an impact. I’ve said it before, and I’ll repeat it now, I am very sceptical about the polling in the UK at the moment. The last major event, the UK general election, did not do much for the pollsters credibility, so why exactly should we believe everything that we’re hearing now? Particularly as a similar dynamic might be in play. Consider it, the ‘Leave’ voters tend to be far more passionate, they are advocates of change after all. It just might be that the polling samples are very difficult to correct for the apathy of those who advocate staying in, and thus we’re not getting a truly accurate picture. It may also be that those who might have passed on voting because they felt that the status quo might be maintained might now be panicked into getting out and expressing their democratic right. I think this is the reality, this is what is likely to happen, this is why I think that in the end the vote will be to remain, with a 3 – 4% majority. We shall see soon enough.

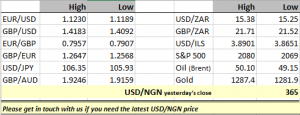

We’re still waiting for the Central Bank of Nigeria to publish information about their plans to make the naira more flexible. As I said a few days ago, it’s hard to imagine a scenario where additional flexibility does not include some sort of devaluation, whether it’s admitted or not, it’s likely that by the end of today there will be some sort of concession. King Canute couldn’t push the tide back, and the Nigerian government cannot fly in the face of economic realities. Already this morning, my sense is that the naira is somewhat weaker than yesterday’s closing. Depending on the quality of the CBN’s announcement the naira is fully capable of achieving some sort of short term recovery. This could happen if the CBN’s announcement allays the concerns of the wider investment community and a path becomes available for outside investors to put money to work in the Nigerian economy. A rally of that sort is likely to be short term however as the realities of daily supply and demand will continue to dominate the value of the naira. In any case we will update you with the CBN’s statement and our view on the implications for the naira going forward.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com

I value the details on your web sites. Thank you!.