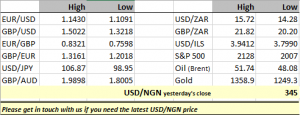

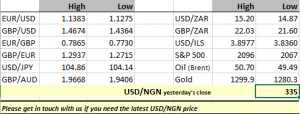

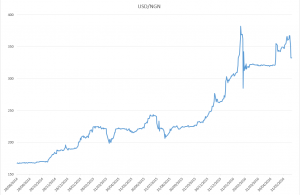

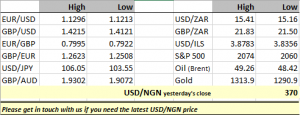

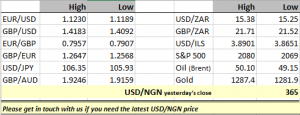

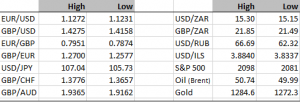

Sometimes I really dislike democracy. It’s ok when people vote as you want them to, but on such a huge decision as this you just feel helpless. The EU referendum results are coming in and it’s fairly certain now that the United Kingdom has voted to leave. The markets have moved in fairly dramatic fashion. As I write this, European bourses are down more than 10%, the Nikkei down 8%, hundreds of billions of dollars in value have been lost. It all seemed so optimistic (if you wanted the UK to vote ‘Remain’) in the late evening, and then I started to get text messages and my phones rang while I tried to sleep. It was obvious that things had taken a turn for the worse. You don’t need to look at the exit polls for a timeline of how the vote was evolving, the chart for GBP/USD is a more potent illustration.

The politics are going to be very interesting now. Some argue that the EU will propose a better deal to keep the UK in, but I’m not sure how feasible that is for any number of reasons. The most obvious is that a large proportion of those who voted to leave, did so on the basis that there would be no circumstance in which they would change their mind. Another thing to consider is that the risk for the EU now, if they were to propose a new deal for the UK, would be that other Eurosceptic leaning countries like Denmark and Poland, and perhaps even the Netherlands might insist on changing their own relationship with the EU as well. Rationally it makes more sense for the EU to take a hard stance, in the hopes that it would dissuade any others from flirting with exit. At this point in time the priority in the upper circles of the EU has surely got to be containment.

In terms of currencies, I would suggest that we will see volatility aftershocks for the next few days. We really are in the unknown at the moment, but for the pound sterling surely there are significant problems ahead. For the last 30 years the UK has been the preferred destination for foreign direct investment into the EU, it’s entirely possible that a significant portion of those investments are now at risk. I have heard stories of major investment banks discussing Brexit contingencies which involve moving operations to places like Frankfurt, Paris and Dublin. But it’s more than that… consider the gilts market, since the global financial crisis of 2008, foreign investors have bought huge tranches UK sovereign bonds and the losses they are experiencing today are catastrophic. Do they hold on, do they stop loss? And what happens to the Eurobond business that’s been conducted out of the City of London for decades, it’s well known that the ECB has not been particularly enthused about so much offshore trading of euro denominated assets. And the big elephant in the room hasn’t even been mentioned yet. London property has been used as an alternative to gold for years, now the entire premise for that flight to safety trade has been put to the question. There are many significant reasons why we could and probably will see a structural outflow from the United Kingdom in the coming years, so it’s hard to be positive about the prospects for the pound sterling at this point in time.

The pound is not the only currency which is likely to be vulnerable now, the euro is surely in the firing line as well. Brexit represents a substantial negative to the Eurozone economy which will have to be reflected in the value of the euro versus other currencies. Even worse the market is likely to assign a break up risk premium to the euro. EUR/USD lower seems likely in my view. In times of uncertainty we would normally expect to see the dollar rally and that’s certainly what we’ve seen so far, but at some point the market will have to consider the fact that rate hikes by the Federal Reserve are probably off the table now. Counter-intuitively this could end up being a great opportunity to buy equities, as it wouldn’t be a huge shock if we see some sort of coordinated response from central banks to calm fears of a global recession. It might end up being the sort of over-reaction we saw in the aftermath of the crash in 1987, but everything always looks obvious in hindsight.

I can only summarise, on a morning in which we have seen a record move in GBP/USD, that we are likely to see a lot of volatility today and in the coming days. As politicians in the UK and the EU scramble to make sense of where we are, it’s likely that they will have a more significant impact on markets than normal. Please make your trading decisions carefully and recognise that heightened uncertainties mean that prices are fluctuating more than normal and spreads are necessarily wider than you have been used to.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com