A potential new element of systemic risk has been introduced to the market according the Financial Times (they didn’t characterise it in that way, that’s me). The Hong Kong affiliate of China’s 8th largest investment bank, Guosen Securities, has defaulted on a renminbi denominated bond (dim sum bond) traded in Hong Kong. The assumption has always been that there is an implicit guarantee from state owned enterprises (SOE’s). This is now open to question and could affect funding for all SOE backed dim sum bonds, and the matter is made worse by the seeming health of the parent company. Are we to distrust appearances now? It wouldn’t surprise me if the yield required by dim sum investors rises after this incident. It would certainly not be unreasonable to demand more return to take the risk in future. This might not sound like a big deal, maybe it isn’t but if investors become reluctant to hold dim sum bonds, we don’t know what the implications could be on the funding prospects of mainland Chinese companies. Just bear in mind that problems with loans started appearing like this in 2007 before the Global Financial Crisis. Not saying it’s the same thing, its noteworthy though, and we know there has been a massive debt build up in China, much of it, not so good…

Still on China, the Asian Development Bank published its Outlook for 2016 yesterday. A slowing China is one of the key risks identified with their forecast for Chinese GDP growth at the low end of the range (6.5%) that the government itself is expecting. A rate rise in the United States is another scenario which could add further downside. Gloom gloom gloom…

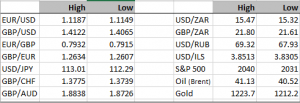

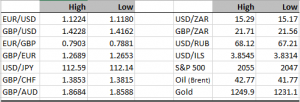

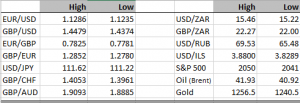

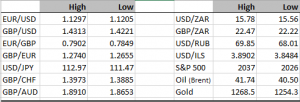

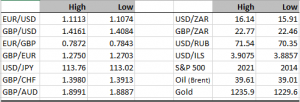

The British pound left to its own devices continues to struggle to hold its level. I observed during the brief dollar selloff that whereas EUR/USD had made a new month to date high in the wake of Yellen’s comments, GBP/USD was unable to break its mid-month high, and today it is already trading weaker while other major currencies are roughly flat against the dollar. This all points to a continuation of the pound sterling weakness we have already identified. It is noteworthy that the Japanese yen is also looking a bit fragile at the moment, and some chartists are looking for a new period of substantial yen weakness, with new multi-year highs.

As we mentioned earlier on in the week, we get big data tomorrow, with the US labour market report, non-farm payrolls. But there’s also some interesting data today, in the UK we get an updated Q4 GDP number, and also Eurozone CPI data.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc