Good morning

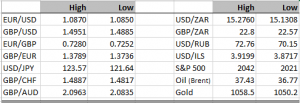

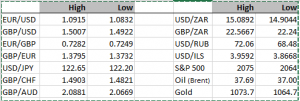

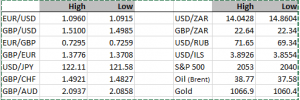

| High | Low | High | Low | |||

| EUR/USD | 1.0938 | 1.0899 | USD/ZAR | 15.6595 | 15.4595 | |

| GBP/USD | 1.4845 | 1.4807 | GBP/ZAR | 23.23 | 22.92 | |

| EUR/GBP | 0.7383 | 0.7346 | USD/RUB | 74.50 | 72.59 | |

| GBP/EUR | 1.3613 | 1.3545 | USD/ILS | 3.9158 | 3.8871 | |

| USD/JPY | 120.59 | 120.32 | S&P 500 | 2065 | 2060 | |

| GBP/CHF | 1.4734 | 1.4628 | Oil (Brent) | 37.01 | 36.57 | |

| GBP/AUD | 2.0382 | 2.0247 | Gold | 1063.0 | 1057.0 | |

Pretty quiet start to the day. Some position squaring likely during the day and traders try leave the office “flat”.

No change to what I have been saying all week really, the USD will rebound into 2016 especially vs the EUR which has been stuck in a range all week.

GBPUSD remains heavy as does EURGBP, however if I am right about the moves expected early January, we could very well see the GBPUSD fall to 1.4565 lows from April, EURGBP back towards 0.70 (1.4285) and EURUSD FINALLY trading towards PARITY. So volatility is expected and coming.

In addition to the EUR, GBP and other major currencies suffering at the hands of the USD, Emerging Currencies too will be hit. Already we have seen the ZAR, TRY, INR, CNY, MYR, MXN, BRL and NGN hit over the past few months as investors seek to exit EM and enter other underlying’s. Remember any investor in EM has to buy local currency, and given the losses we have seen in recent months any gains from investments have been dented (and then some) by the losses on the currency. So expect this to carry on into 2016.

WE AT PARITYFX WOULD LIKE TO WISH ALL OUR READERS A HAPPY NEW YEAR. MAY 2016 BRING YOU MUCH HEALTH, HAPPINESS AND PROSPERITY. THANK YOU ONE AND ALL FOR YOUR SUPPORT

HERE’S TO 2016 – CHEERS 🙂

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc