Just when the Federal Reserve had taken a step towards monetary orthodoxy the Bank of Japan reminded us of the quandary in which the global economy resides. Last night the Japanese central bank cut rates to -0.1%. You’re not reading that incorrectly, negative zero point one percent! Some of the European central banks have toyed with negative interest rates, short term sovereign debt in the Eurozone trades in negative territory, but here we have, for the first time, a major Asian economy crossing the zero bound. Is this even ZIRP (zero interest rate policy) anymore? Perhaps a new phrase will be coined for this new frontier. Stock markets and the commodities complex reacted positively to the news, and not surprisingly the Japanese yen fell significantly. No one should be in any doubt that the point of this exercise was to weaken the yen, and so far the Bank of Japan has been successful. Whether that lasts for long will depend to a certain extent on how other central banks react, and more pertinently how the Peoples Bank of China responds. This is what people mean when they talk about currency wars. I’ve never been a fan of ZIRP and quantitative easing, I feel the corporates who made bad decisions have been given a free option and are being bailed out while the poorer percentiles of society are left to carry the load. But the implications of the Bank of Japan’s actions could have deeper more malignant consequences than anything we’ve seen before. I’ll start off by saying that if a small South American economy was doing this there would be a far more critical response than what we’re likely to see. I say this because already the Japanese authorities own a substantial proportion of their own debt, whereas the QE in the United States and the Eurozone has involved the vast majority of government debt remaining in private hands. We really don’t know what could happen if this proves to be an error, but one of the worst case scenarios is certainly hyper-inflation. Perhaps it doesn’t happen because of the debt super-cycle and the consequential deflationary tendencies in the global economy, but I can’t help but feel a great deal of discomfort at some of the policies institutions we should trust and respect are coming up with.

In Nigeria the President has come out in support of the central bank (CBN). A few days ago they maintained their official peg for the naira to the US dollar despite the parallel market rate seeing a greater than 50% widening from the peg level. I think the endgame here is a little bit more predictable. It’s hard to see how further devaluations can be avoided in the next year or two. As things stand the naira has continued to weaken in the parallel market, and it’s hard to see this ending anytime soon. Worse still the market is becoming comfortable with trading at the 300 level, so it could be here to stay. One of my traders was telling me just this morning that they missed out on a deal to sell NGN at 310, so you can bet that a deal was concluded above that level in the last couple of hours!

In Southern Africa, the central bank (SARB) has taken a more orthodox approach and raised rates 0.5%. The second hike in the last few months. The rand rallied on the news, and is still trading in positive territory today. Not before time the SARB has recognised that there will be an inflationary price to pay from the recent falls in the rand. While I recognise the seeming irrationality of tightening policy when the economy is already stuttering, it’s always the poor that suffer when inflation runs out of control – there are a lot of poor voters in South Africa. It should not be up to monetary policy to provide solutions to a country’s economic ills. That is after all what governments should be about in a functioning democracy. Over to you President Zuma.

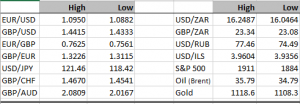

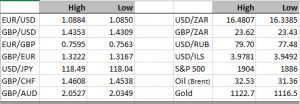

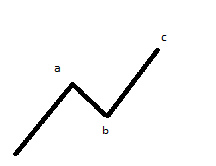

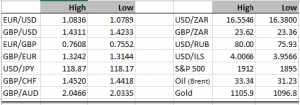

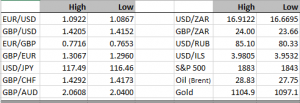

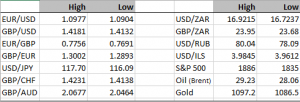

Apart from against the Japanese yen, the greenback has been in retreat against a broad range of currencies. It’s not clear to me that this situation will last for much longer. Indeed both GBP/USD and oil look to be completing corrective bounces and I would expect to see the bearish trend regaining strength in the next few days. Later on today we’ll get some GDP data, consumer spending and wages data in the United States. I think that both the consumer spending and wages data will be worth noting. That’s exactly the sort of stuff the Federal Reserve will want to use to defend their relatively hawkish stance in a world of unorthodoxy policies.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc