Good day

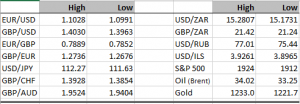

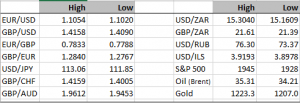

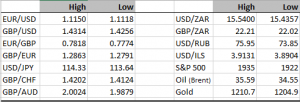

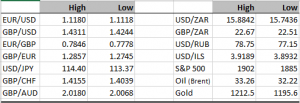

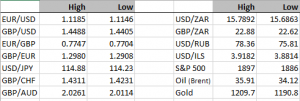

| High | Low | High | Low | |||

| EUR/USD | 1.0960 | 1.0911 | USD/ZAR | 16.2700 | 16.0500 | |

| GBP/USD | 1.3916 | 1.3840 | GBP/ZAR | 22.54 | 22.23 | |

| EUR/GBP | 0.7898 | 0.7870 | USD/RUB | 76.84 | 84.05 | |

| GBP/EUR | 1.2706 | 1.2661 | USD/ILS | 3.9390 | 3.8890 | |

| USD/JPY | 114.03 | 112.76 | S&P 500 | 1949 | 1929 | |

| GBP/CHF | 1.3862 | 1.3795 | Oil (Brent) | 36.02 | 35.17 | |

| GBP/AUD | 1.9523 | 1.9404 | Gold | 1231.0 | 1215.0 |

Another day another GBP sorry day. GBPUSD opens at 1.3900 having dipped to 1.3840 in Asia. I find it strange in a way as all the current polls show the STAY camp winning. Obviously there is more than meets the eye and the problems facing the UK are deeper than simply the referendum. We know the Gov of the BoE sees UK rates staying on hold for longer than anticipated given the state of the UK economy. Talk of decreasing government spending has added to the UK woes. All in all the “ides of March” seems to be rearing its ugly head. In my humble opinion I think despite Boris joining the OUT camp, the STAY camp will win which could very well see the GBP mount an impressive recovery. So while things are looking rough at the moment come June 23rd, if STAY does in fact win, we could see EURGBP back towards 0.73-0.74 levels and the GBPUSD up a few hundred pips.

An article published over the weekend in the German magazine Der Spiegel states that Greece will face great difficulties servicing their debt in March. No doubt the migrant problem is an unwanted problem which is now starting to weigh heavily on the Greek Central Banks coffers. “The IMF insists on the promises of the Greeks regarding the reforms and puts obstacles on the pending programme review, which would give the green light to the participation of the fund in the third bailout programme”. The EU do not know what’s hit them. With talk of an extra 1,000,000 migrants heading West over the summer, the EU faces immeasurable hardships over the coming years. We have seen borders fenced up with the likes of Austria, Slovakia and Bulgaria all erecting fences to keep migrants out. The migrant issue will in my opinion see governments topple and right wing parties have more say in their respective countries. Not for one minute did politicians think it would get so bad. Crime has gone Bezerk in Austria and Germany and it is no wonder the UK is trying their best to keep the borders closed and in so doing avoid the problems that the aforementioned are witnessing.

The ZAR has seen last week’s gains (pre budget) given up and traded above 16.00 (unfortunately). The Finance Minister did the market no favours in last week’s budget and even the 0.75% rate hike in recent weeks has not helped matters. Now the FM together with the SARB governor will be thinking will they have to raise rates again. I know inflation has topped 6% (6.2% recent) but will the rate hikes bring inflation down below 6% and back into the range? I am not sure. S.Africa are importing inflation, so rather than raising rates, why not let the ZAR depreciate further and slow down imports and make exports more attractive? Surely that is a better short term plan? With global markets slowing down (China, US, UK, EU) I think the S.Africans should withstand hiking rates which could damage the already fragile economy and rather use external means to fix the problem.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc