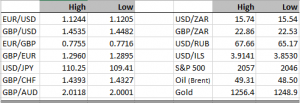

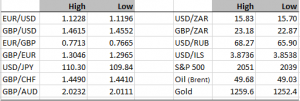

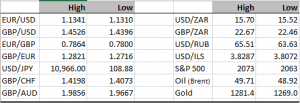

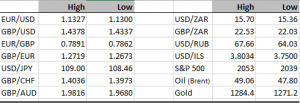

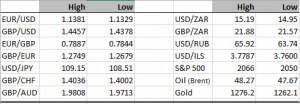

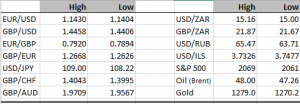

| High | Low | High | Low | |||

| EUR/USD | 1.1228 | 1.1204 | USD/ZAR | 15.81 | 15.65 | |

| GBP/USD | 1.4500 | 1.4473 | GBP/ZAR | 22.90 | 22.66 | |

| EUR/GBP | 0.7752 | 0.7729 | USD/RUB | 67.90 | 65.80 | |

| GBP/EUR | 1.2938 | 1.2900 | USD/ILS | 3.8750 | 3.8568 | |

| USD/JPY | 109.47 | 109.16 | S&P 500 | 2050 | 2044 | |

| GBP/CHF | 1.4365 | 1.4317 | Oil (Brent) | 48.93 | 48.35 | |

| GBP/AUD | 2.0166 | 2.0032 | Gold | 1252.0 | 1243.0 |

Honestly it has been a pretty “quiet” week fundamentally and economically.

There have been a number of FED members speaking this week (Presidents Bullard and Williams last night and Board Governor Jerome Powell on Thursday) and clearly they are preparing the financial markets (albeit dependent of US economic data to reinforce their decision) for a US rate hike in June. I have noted previously that with the US elections in November, July was in all probability the “cut off” for a US rate hike pre elections. So it would appear the FED are likely to strike while the iron is hot and get the hike out the way, or else risk having to commit political suicide and hike ahead of the elections in September or November (a no no!!). That would leave potentially 2 hikes for 2016 (June and December) which was not on the FED’s agenda if you remember back in December. They were hoping for 4 hikes in 2016, however with the US economy chugging along and China in all sorts of trouble, it looks like they (the FED) will have to settle for 2 hikes in 2016. You can argue, 2 is the best they can hope for under the circumstances. The FED though will be hoping the economic data over the forthcoming 3.5 weeks warrants such a move. The NFP number earlier this month certainly did not impress (+160k) so clearly the FED will be hoping for a rebound on the 3rd June in conjunction with Retail Sales, inflation, Wage growth and Industrial Production. Here is a something to mull over, what if China GDP and economic data shows further signs of deterioration and contraction (and they devalue the CNY) – can you see the FED pulling the trigger? Oi vei!!

The USD has as a result of the increased likelihood of a rate hike enjoyed a rally vs the EUR, AUD, GBP (though that’s mostly EU referendum based) and JPY (from her recent lows). You can see from the table above, the FX markets have been pretty quiet and tight overnight as traders cite a lack of data and incentives to prompt another round of USD buying. That is not to say it won’t come as we get closer to NFP (3rd June) and FED Chair Yellen’s speech on 6th June. Clearly the FX market is being ultra-cautious and trying to pip the market rather than hit a home run. Not worth throwing your annual budget out the window when things are as unclear as they are. Kinda like jumping into the waters surrounding Seal Island (Gaansbaai, Cape Town) when visibility is down to a couple meters. Trust me I should know, and it was scary (yes I was in a cage).

The GBP – honestly what more can we write. It is starting to get ugly now with both sides throwing wild accusations at each other. Mr Boris and your followers, you have made some solid arguments but why don’t you answer this question (one we have posed many times and I bet you can’t answer), FX traders have confirmed should the UK vote to leave the EU, the GBP will devalue at least 10% (potentially to 20%) leaving UK citizens 10-20% worse off when travelling and 10-20% poorer as prices rise to counter the fall in the GBP. In fact only yesterday the CEO’s of Tesco, Sainsbury’s, M&S and B&Q all issues a stark warning that shop prices will rocket and prove “catastrophic” for families. The article in the Daily Mail also mentioned there would be an increase in inflation, job losses and ultimately an increase in the UK base rate to counter the plunging GBP. IS THAT WHAT YOU/WE WANT? Honestly do you really want to see you net income fall 20% at the drop of a hat!! I certainly don’t. I will leave it at that, I think I have said it all. Boris and Michael if you are reading this, please can you reply, thank you.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com