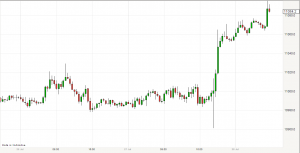

The FOMC announcement after the meeting makes clear that further rate rises are a possibility in 2016. It looks like the stronger than anticipated jobs data from the start of this month has persuaded FOMC members that the labour market is regaining momentum and near term risks to the US economy are diminishing. Rates were unchanged of course, no one ever expected them to do anything this time around. It was always going to be about the outlook of the Federal Reserve, and clearly Brexit concerns are receding. After the announcement the dollar initially rallied but quickly reversed.

For your guide, there are 3 more FOMC meeting left this year, and it is a reasonable bet to expect a rate rise at one of these meetings. Given the election later on this year, one would expect it to happen sooner rather than later, September would be my guess. The Federal Reserve is still likely to keep a close eye on the global economy and they have left themselves enough room to delay action if data in proceeding months turns out to be more negative than expected, so all eyes no doubt will be watching activity in the UK – don’t pay too much attention to the UK growth numbers yesterday, that relates to activity before Brexit.

It’s certainly interesting to note that the Fed has not reacted as negatively to Brexit as the IMF for example, as they have still maintained their growth forecast for the US economy. Surely if they were in tune with the IMF then the negative outlook for the global economy as a whole would have also impacted the US economy. Some FOMC members did however state that they would prefer to see more signs of an inflationary threat before hiking rates further.

I don’t see the reversal of the initial dollar rally as a sign that the dollar is going to get weaker from here. Rather it looks to me that the market, which was already starting to price in the possibility of further hikes this year, is seeing a bout of profit taking. Granted the dollar could sell off further in the coming days, but this only opens the way for a renewal of a bullish dollar trend. As I mentioned in a recent blog, the case for the dollar to appreciate versus its European peers remains strong to me, indeed it’s been reinforced by the Fed’s pronouncement. Look across the Atlantic and you’ll notice that both the Bank of England and ECB are far more likely to ease monetary policy in the coming months. Once again the major central banks are moving in opposite directions, it’s hard to see why that won’t see EUR/USD and GBP/USD eventually moving lower as well.

DISCLAIMER

Any financial promotion contained herein has been issued and approved by ParityFX Plc (“ParityFX”); a firm authorised and regulated by the Financial Conduct Authority (“FCA”) as a Payment Services Institution with registration number 606416. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to.

Opinions expressed are subject to change without notice and may differ or be contrary to the opinions or recommendations of ParityFX. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. To the extent permitted by law, ParityFX does not accept any liability arising from the use of this communication.

Follow our tweets @parityfxplc

Follow us on LinkedIn ParityFX Plc; and at www.parityfx.com